Publications

Complying with the 2017 New York State Minimum Wage and Exempt Salary Thresholds

As a result of the New York State Department of Labor’s (NYSDOL) adoption of new rules and amended wage orders, effective December 31, 2016, New York employers are now subject to minimum wage increases and corresponding increases to the salary level thresholds for employees to qualify as “exempt” from minimum wage and overtime requirements in New York. By way of background, in April 2016 the New York State legislature passed a budget that included an incremental minimum wage increase, which will ultimately reach $15 an hour for all workers in all industries across the state. In October 2016, the NYSDOL proposed amendments for corresponding increases to the salary thresholds for exempt executive and administrative employees, and on December 28, 2016, the NYSDOL adopted the proposed rules and amended the minimum wage orders accordingly.

New York Minimum Wage Increases

The New York minimum wage hike will be implemented incrementally using a four-tiered system, with different wage rate increases dependent on region and size of the business.[1] The full schedule of increases in the New York State hourly minimum wage is listed in the following chart:

*Annual increases for the “Rest of the State” will continue until the rate reaches $15 per hour. Beginning in 2021, these annual increases (based on certain economic indices) will be published by the Department of Labor on or before October 1.

As provided by the NYSDOL in a recently published Frequently Asked Questions section, employers must generally pay the applicable minimum wage rate based on where the employee performs his or her work, regardless of where the employer’s main office is located. Moreover, if an employee works in two regions, the employer may pay each hour worked in each region at the applicable minimum wage rate for that region, or simply pay the higher rate for all hours worked.

The New York minimum wage increases also impact businesses that employ tipped workers who receive a lesser minimum “cash wage.” In 2016, tipped employees in the hospitality industry – “service employees” and “food service workers” – were entitled to the same minimum cash wage of $7.50 per hour provided that the employee received enough in tips to bring him or her up to the previous State minimum wage of $9.00 per hour. However, as a result of the new rules, service employees and food service workers are now entitled to different minimum cash wage rates and are subject to different rules.[2]

Food service workers are employees primarily engaged in the serving of food or beverages to patrons, including, for example, wait staff, bartenders and bussing personnel, who regularly receive tips from such patrons. (Delivery workers are not considered food service workers). In 2017, the minimum cash wage for food service workers remains at $7.50 per hour throughout New York, however, the maximum available tip credit for employers differs based on the employer’s size and location. Accordingly, an employee’s minimum cash wage plus the tips received must equal or exceed the applicable hourly minimum wage rate. For example, food service workers working in large New York City businesses in 2017 must receive a minimum cash wage of $7.50 per hour (where the employer takes a maximum $3.50 per hour tip credit) and receive enough tips so that their total wages equals at least $11.00 per hour. The full schedule of increases to the hourly minimum cash wage for food service workers and maximum tip credits available to employers in New York is listed in the following chart:

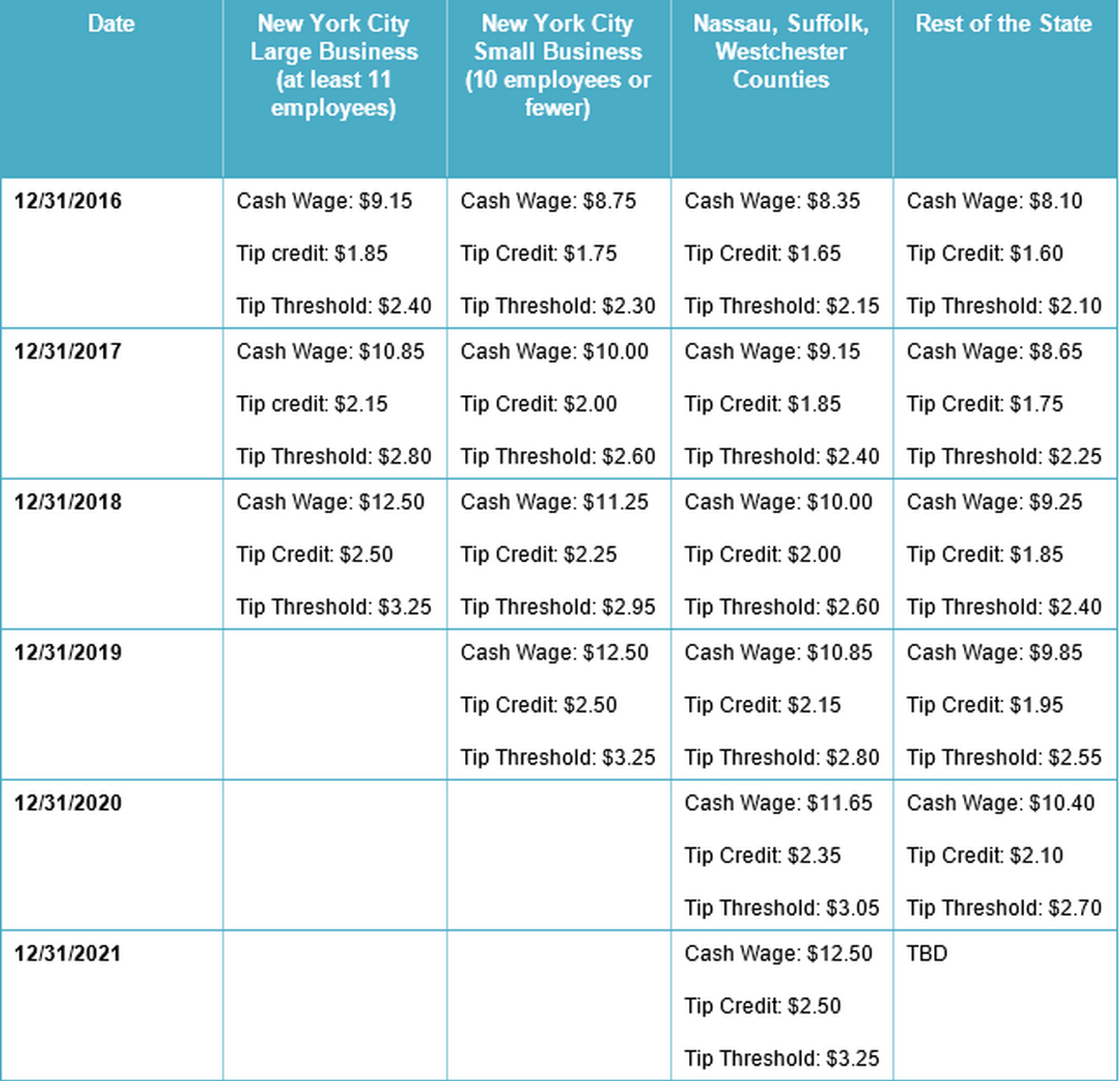

Service employees, on the other hand, are entitled to a higher minimum cash wage than food service workers, and must receive a weekly average of tips that is equal to at least the hourly “Tip Threshold” listed in the chart below. Service employees are defined as employees, other than food service workers or fast food employees, who customarily receive tips at or above the Tip Threshold, such as delivery workers, coat check personnel and hosts and hostesses. Still, as is the case with food service workers, the total of tips received plus the minimum cash wage must equal or exceed the applicable basic hourly minimum wage (based on region or size of business). For example, a service employee working in a large New York City business in 2017 must receive a minimum cash wage of $9.15 per hour (where the employer takes a $1.85 tip credit), provided that the employee’s weekly average of tips (“Tip Threshold”) is at least $2.40 per hour[3] and the total of tips received plus the minimum cash wage equals at least $11.00 per hour. See the following chart for the rate increases applicable to services employees:

It is important to note that employers in the hospitality industry may not take tip credits for days when tipped employees spend more than two hours, or twenty percent of a shift, (whichever is less) performing non-tipped work (e.g., food preparation).[4]

New York Exempt Employee Salary Threshold Increases

In previous articles, we had discussed the U.S. Department of Labor’s publication of its final rules increasing the salary level threshold for the Fair Labor Standards Act’s “white collar” exemptions, and the subsequent nationwide blocking of such rule by a federal judge in the Eastern District of Texas. Despite the block at the federal level, New York has enacted its own increases to the minimum salary level thresholds for exempt executive and administrative employees in New York, effective December 31, 2016,[5] resulting in many more employees now being entitled to overtime pay for hours worked over 40 in a workweek.[6]

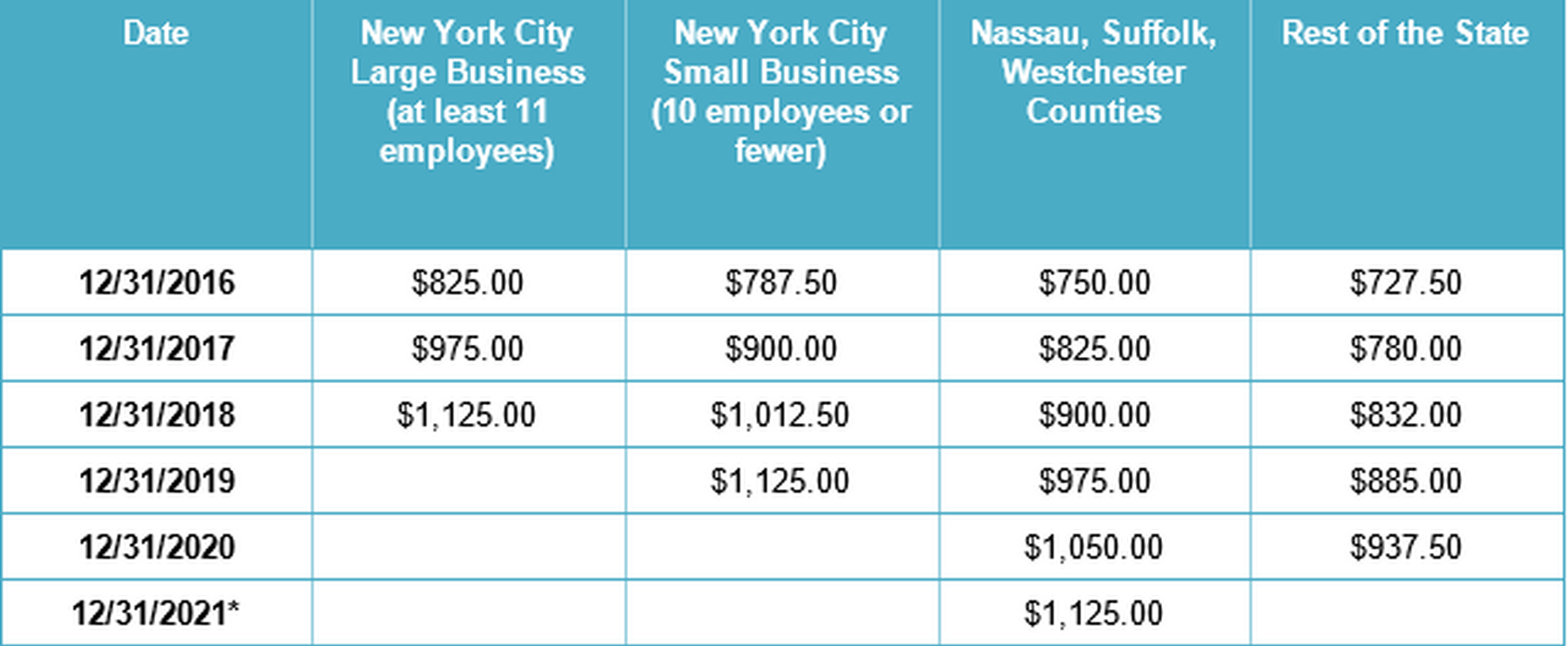

As with the minimum wage increases, the salary threshold amounts depend on the region and size of the employer’s business. For example, in 2017, an employee working in New York City for a large business must earn at least $825 per week ($42,900 annually) to qualify as exempt – a significant increase from the previous $675 per week, or $35,100 annual, threshold. This threshold level will continue to increase until it hits $1,125 per week ($58,500 annually) on and after December 31, 2018. The schedule below reflects the State-wide increases to the weekly minimum salary thresholds for exempt employees:

As with the new minimum wage rates, these salary thresholds are dependent on where the employee performs his or her work, regardless of where the employer’s office may be located.

Incidentally, employers should be aware of a quirk in the law that, under certain circumstances, permits employers (except employers in the hospitality and building services industries) to pay overtime to certain employees at a rate of one and one-half times the New York minimum wage for hours worked over 40 in a workweek – as opposed to the general rate of one and one-half times the employee’s regular rate of pay. The degree to which (and method by which) this quirk can be applied involves complex issues beyond the scope of this article and should be discussed with experienced employment counsel before implementation.

Next Steps

As a result of the new rules, New York employers must immediately update their minimum wage rates and payroll practices to ensure complete compliance with the amended wage orders, which includes posting the updated New York State minimum wage poster[7] in a conspicuous place in the workplace and distributing new wage notices to employees in the hospitality industry. As a reminder, employers outside of the hospitality industry need not provide written notice to an employee if there is an increase in a wage rate that is reflected in the employee’s pay stub – a notice must only be provided if there is a decrease in an employee’s wages or if other information on the notice (e.g., the employer’s address) changes.

Moreover, due to the significant increases to the New York exempt salary thresholds (despite the injunction against the federal rule), many executive and administrative employees in New York may no longer qualify as exempt from state minimum wage and overtime requirements. Accordingly, New York employers must analyze whether it makes sense – financially and from an employee relations standpoint – to raise the salaries of their executive and administrative employees in order to maintain such employees’ exempt status. Otherwise, those employees, who were once classified as exempt but no longer meet the new applicable salary threshold, will have to be paid overtime for hours worked over 40 in a workweek.

The changes in the amended wage orders are complex and nuanced and may be difficult for employers to put in practice. Accordingly, employers are encouraged to consult with their employment counsel to help analyze any issues and determine best practices for compliance and moving forward.

[1] A separate minimum wage and schedule of increases applies to employees working at establishments in the New York State “fast food industry,” which generally means a business that primarily serves food or drinks; that offers limited service, where customers order and pay before eating, including restaurants with tables but without full table service, and places that only provide take-out service; and that is part of a chain of 30 or more locations, including individually owned establishments associated with a brand that has 30 or more locations nationally. As of December 31, 2016, such employees are entitled to a $12.00 per hour minimum wage within New York City and $10.75 per hour in the rest of the State. These rates increase annually until they reach $15 per hour at the end of 2018 for New York City and in 2021 for the rest of the State. Employers in the fast food industry are not permitted to take a tip credit against the minimum wage.

[2] New York employers in the hospitality industry should also be aware that there are new requirements for uniform maintenance pay and with respect to credits for meals and lodging that may be provided to an employee as a part of the employee’s wages.

[3] Service employees working at resort hotels are subject to different requirements.

[4] Workers outside of the hospitality and building services industries in New York (e.g., employees in “miscellaneous industries and occupations”) are subject to different tip allowances, which, as with the allowable tip credits for the hospitality industry, are based on the employer’s location and size of business.

[5] There is no salary threshold for professional employees in New York.

[6] As a reminder, in addition to meeting the minimum salary level threshold, most employees must also perform certain duties in order to be classified as exempt.

[7] The following is a link to the general New York Minimum Wage Poster: https://labor.ny.gov/formsdocs/wp/LS207.pdf. Here is a link to the Hospitality Industry Minimum Wage Poster: https://www.labor.ny.gov/formsdocs/wp/LS207.3.pdf.

For more information on the topic discussed, contact:

Employment Notes, a newsletter produced by Tannenbaum Helpern Syracuse & Hirschtritt LLP’s Employment Law practice, provides insights on recent employment caselaw, legislation and other legal developments impacting employer policies, human resource strategies and related best practices. To subscribe to the newsletter, email marketing@thsh.com.

03.01.2017 | PUBLICATION: Employment Notes | TOPICS: Employment